What is a Centralized Exchange?

A centralized exchange (CEX) is a business that helps to make transactions between two or more parties happen. It's a platform where cryptocurrency trading occurs, and transactions are managed through centralized entities or intermediaries; some examples of CEX are Ticoex, Binance, Bybit, etc. This is quite different from decentralized exchanges(DEX) that operate on peer-to-peer (a type of transaction that does not involve any intermediaries).

Table of Contents

What Are Centralized Cryptocurrency Exchanges?

Centralized cryptocurrency exchanges are regulated businesses or online platforms that make the buying, selling, and trading of cryptocurrency and other digital assets easier. They are referred to as "centralized" because they are regulated and managed by specific entities or organizations that perform the role of an intermediary, overseeing every transaction, providing liquidity, and maintaining security. Some of the core functions that make them different from other trading platforms are;

-

It allows users to freely buy and sell a wide range of digital assets such as Bitcoin (BTC), Ethereum (ETH), e.t.c

-

It stores digital assets for users, making sure that none of the assets in the digital wallets controlled by the exchange is lost.

-

It also provides efficient trading tools, charts, and technical analysis for users, making it a favorite of both beginner and advanced traders.

History of Centralized Cryptocurrency Exchanges

Over time, centralized cryptocurrency exchanges have evolved as they continuously and closely follow the growth and development of the crypto market. The timeline of evolution is as follows;

-

The Early stage/Growth stage: It all started when Satoshi Nakamoto launched Bitcoin in 2009. Its transactions were done directly between individuals, and in 2010, the first Cex(BitcoinMarket.com) was introduced, and it allowed the trading of Bitcoin for fiat currencies relying solely on trust in the exchange operator. In 2011, Mt.Gox took over the world by storm, becoming the most popular CEX and handling over 70% of Bitcoin transactions around the world.

-

Modernization/ Security focus: After the bull run in 2017, there was a huge spike in how much the world focused on CEX. The security had to be tightened after hacks and regulations were made, making CEX adopt strict KYC for users and other security measures.

CEX Key Elements

The key elements or features of CEX are

-

Order Book: To provide transparency, CEX keeps a record of every buy and sell order, which helps in price discovery and liquidity.

-

Liquidity: they have higher liquidity because of their larger user base and detailed order book, which makes trading happen easily and quickly.

-

Fiat Gateways: A lot of CEx support fiat currency, allowing crypto trading to occur using traditional currencies.

-

Customer Support: Customer service is readily available for users with complaints or in need of assistance.

-

Custodial Service: It safely keeps digital assets for users in wallets managed by the exchange.

CEX vs. DEX

Centralized exchanges are quite different from decentralized exchanges in a few ways such as;

CEX |

DEX |

|---|---|

|

Controlled or overseen by a central authority |

No intermediaries, operates on a peer-to-peer basis |

|

Assets are held and protected by exchange |

Private keys and assets are held by the users |

|

Fast as it relies on controlled infrastructure |

Slow as it relies on blockchain transactions |

|

Identity verification is often required |

Allows anonymous trading |

|

Very regulated, subjected to critical regulatory observation or examinations |

Generally less regulated |

Centralized Exchange Regulations

These are sets of legal rules and requirements that control how CEX operates. CEX regulations exist to ensure transparency, prevent illegal activities, and protect users. Some of these regulations are

-

KYC Requirements For Users: Centralized exchanges are expected to implement KYC procedures, which involve collecting users' personal information and documents to verify their identity.

-

Anti-money Laundering Compliance: CEX is expected to detect and prevent every money laundering scheme.

-

Licensing: They are expected to obtain a license before operating in some, if not all jurisdictions.

-

Security/Customer Protection: They are expected to implement strong cybersecurity measures for customer protection.

-

Asset Listing and Stable Coin: In some jurisdictions, before some assets can be listed, they must meet some criteria to avoid scams and Ponzi schemes.

Centralized Exchanges Concerns

There are some concerns and risks associated with using centralized exchanges. Some of those concerns are;

-

Security vulnerabilities: Because these exchanges hold lots of digital assets, they have become targets of hackers and cyber threats

-

Regulatory risks: The regulations CEX follows in different jurisdictions vary widely, making it risky for users and might result in accounts being frozen or causing some restrictions for users in certain countries or locations.

-

Technical issues: Some technical issues can arise when maintenance is ongoing or when downtime during high trading volume may interrupt trading.

The Most Trusted CEX?

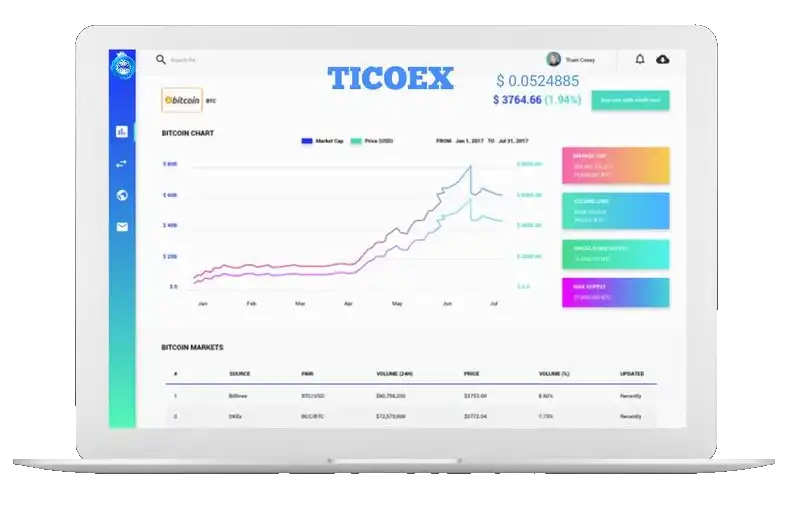

When talking about trusted CEX, Ticoex can't be left out of the conversation; it is a leading and trusted centralized exchange that makes users' trust and comfortability its priority, with a lot of features and security measures (multi-factor authentication). The platform’s robust infrastructure supports high-volume trading, and its commitment to transparency and innovation builds credibility among users. It is designed to accommodate both novice and experienced traders and complies with the regulations of every country in which it's available, making it reliable. It also has an emergency insurance fund, just like Binance has SAFU.

Conclusion

The mass adoption of cryptocurrencies by investors has been aggressive in recent times because centralized exchanges like Binance, provide accessible and user-friendly platforms as well as advanced trading tools, fiat integration, and high liquidity. Although some concerns have been expressed by some users over centralized exchanges concerns like privacy, security, and custodial control of assets, allowing some to prefer the use of decentralized exchanges when choosing convenience, speed, safety against unauthorized users, and legal regulations without any doubt, users know the best option is centralized exchanges.

FAQs

What is or are cryptocurrency exchanges?

◄

These are platforms where users or customers can buy, sell, or trade their digital assets or cryptocurrencies. These exchanges can either be centralized (CEX) or decentralized (DEX).

What is the difference between CEX and DEX?

◄

A central authority manages and controls CEX while offering features like fiat trading, but DEX is peer-to-peer without any intermediaries, giving users full autonomy.

What are the advantages of using CEX?

◄

Apart from the interface being user-friendly, it also offers features that include fiat trading, high liquidity, and advanced trading tools.

What is an order book, and what does it do?

◄

It is a digital book or record of buy and sell orders, which helps to promote transparency and facilitates trade.

Why does CEX require KYC verifications?

◄

They require KYC verifications to meet and comply with regulatory standards while also preventing money laundering and other scams.

How does CEX ensure the security of user funds?

◄

CEX ensures total protection of funds by using multi-factor authentications to ensure unauthorized users do not transfer funds.

What happens if a CEX is hacked or goes bankrupt?

◄

There are insurance funds or emergency funds that have been put in place by most CEX in case of a scenario like this. An example is Binance's SAFU.

Can I access my private keys on a CEX?

◄

No, you can't because CEX manages private keys for users, as CEXs are custodial. Users have to rely on the exchange's security.

How do centralized exchanges make money?

◄

They make money through fees such as listing fees for new tokens, trading fees, withdrawal fees, and other services like staking.

Why should I choose CEX?

◄

Choose a CEX for the following reasons such as; convenience, high liquidity, and fiat support.